Even though joining the National Pension is mandatory for most residents in Japan, paying the monthly contributions isn’t always easy—especially for students, low-income earners, or those facing financial hardship. Fortunately, Japan offers systems like exemption and payment postponement to help reduce the burden. But before we explore those options, let’s first take a look at who is actually required to join the National Pension system.

As a foreigner living in Japan, you are required to join the National Pension if you meet the following conditions.

Who Must Join the National Pension?

- Foreign residents in Japan (with a valid visa)

- Aged 20–59

- Not enrolled in Employees’ Pension (If you work for a company, you are usually enrolled in Employees’ Pension instead of the National Pension.)

- If you are self-employed, a freelancer, unemployed, or a student, you must join and pay National Pension contributions.

The contribution amount for the National Pension is ¥17,510 per month from April 2025 to March 2026.

About National Pension Contribution Exemption/Payment Postponement

In Japan, the National Pension Contribution Exemption and Payment Postponement System allows individuals facing financial difficulties to reduce or delay their National Pension contributions while still maintaining their pension eligibility.

Here’s a breakdown of the system:

1. National Pension Contribution Exemption System

This system allows full or partial exemption from paying National Pension contributions if an individual has a low income or is facing financial hardship.

<Eligibility>

- Resident of Japan (including foreign nationals with a valid visa)

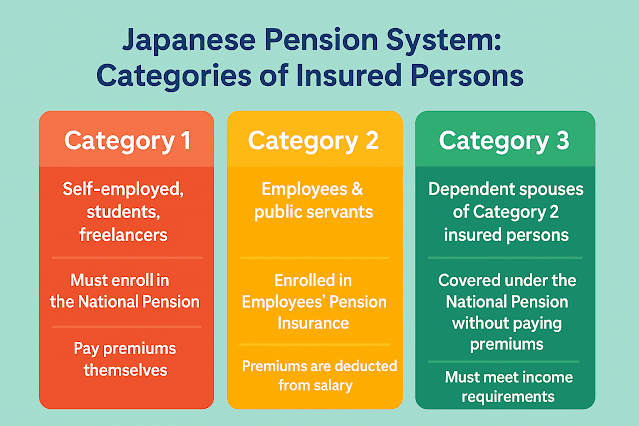

- Registered in the National Pension system (Category 1 insured persons, ages 20–59)

- Each income of you, your spouse (including one not living with you) or household head in the previous year(s) is lower than a certain amount

- Unemployment, disability, or disaster-affected individuals may qualify

| Exemption Type | Amount Exempted | Pension Benefits Accrued |

|---|---|---|

| Full Exemption | 100% exempt | 50% of pension benefits accrue |

| 3/4 Exemption | 75% exempt | 5/8 of pension benefits accrue |

| Half Exemption | 50% exempt | 3/4 of pension benefits accrue |

| 1/4 Exemption | 25% exempt | 7/8 of pension benefits accrue |

Important Notes:

- Exemption is not automatic—you must apply every year.

- The exempted period counts toward pension eligibility but reduces the pension amount.

- You can make back payments within 10 years to restore the pension amount.

2. Payment Postponement System

This system allows young individuals (under 50) with low income to defer their National Pension contributions.

<Eligibility>

- Aged 20–49

- Income below a certain threshold

- Category 1 insured persons (self-employed, freelancers, unemployed individuals, etc.)

- Spouse’s income is also considered

For more details, please refer to this pdf provided by the official website.

Application for National Pension Contribution Exemption / Payment Postponement

What’s the difference between exemption and postponement?

The biggest difference is whether it affects the amount of the old-age basic pension.

When it comes to postponement, if you make additional payments, you receive the amount of the old-age basic pension in full.

In case of not doing, the amount dose not increase.It is good to think of postponement as a chance to make up during financial emergencies.

What if you are examined not to be qualified?

Even if you are not working, there is a possibility that you may not be granted because your spouse’s incom exceeds the dependent eligibility threshold.

In that case, you can be covered as Category 3 insured person under the National Pension system. (Being exempt from paying National Pension premiums as a dependent spouse of an employee.)

Conclusion

If you’re experiencing financial hardship, applying for National Pension Contribution Exemption or Payment Postponement can help you maintain pension eligibility while reducing immediate financial burdens. Since rules can vary by municipality, it’s best to consult your local pension office for specific details.